The hotly debated and legally challenged world of prediction markets has rocked the gambling industry landscape in the US, provoking a key question: When is a bet not a bet?

Prediction markets operator Kalshi has received the most flak from opponents who argue that any market on a sports event is basically sports betting.

Being the first of the nationally regulated financial exchanges to offer prediction markets in the US, Kalshi has found itself first on the hit list of state regulators who are demanding that its sport services should be subject to regional gambling legislation.

Each state in the US issues its own gambling licenses and approved operators are subject to local tax revenue laws.

As prediction markets are federally regulated, they fall outside the auspices of local state law so do not have to contribute to state tax or adhere to the usual customer protection policies set around gambling.

Who Are The Prediction Market Companies?

The big players in the US are Kalshi, founded by MIT graduates Tarek Mansour and Luana Lopes Lara; Robinhood which is integrated with Kalshi; crypto-based platform Polymarket, which has been operating offshore and outside of regulation but is preparing to re-enter the US; Interactive Brokers, which focuses more on the political and economic arenas; and Crypto.com Sports which has just launched after teaming up with fantasy sports company Underdog.

You can appreciate why this has become such a big financial issue for individual states when you consider sports prediction markets exceeded $2 billion in trading volume at Kalshi in the first half of this year.

Last week, Kalshi announced it was spreading its wings outside of the US after raising $300 million from a funding round, bringing the firm’s total valuation to an estimated $5 billion.

Its services were immediately rolled out to over 140 countries, although the product is still restricted from some major marketplaces such as the UK, Canada and France.

While its multimillion-dollar fundraiser and global expansion has made the US gambling industry sit up and take notice, Kalshi has continued to operate legally at a federal level while facing opposition in the US courts.

In another huge development last week, Intercontinental Exchange announced it was making a $2 billion investment in Polymarket, which has just secured a regulated return to the US.

That move by the parent company of the New York Stock Exchange valued Polymarket at around $8 billion.

How Do Prediction Markets Work?

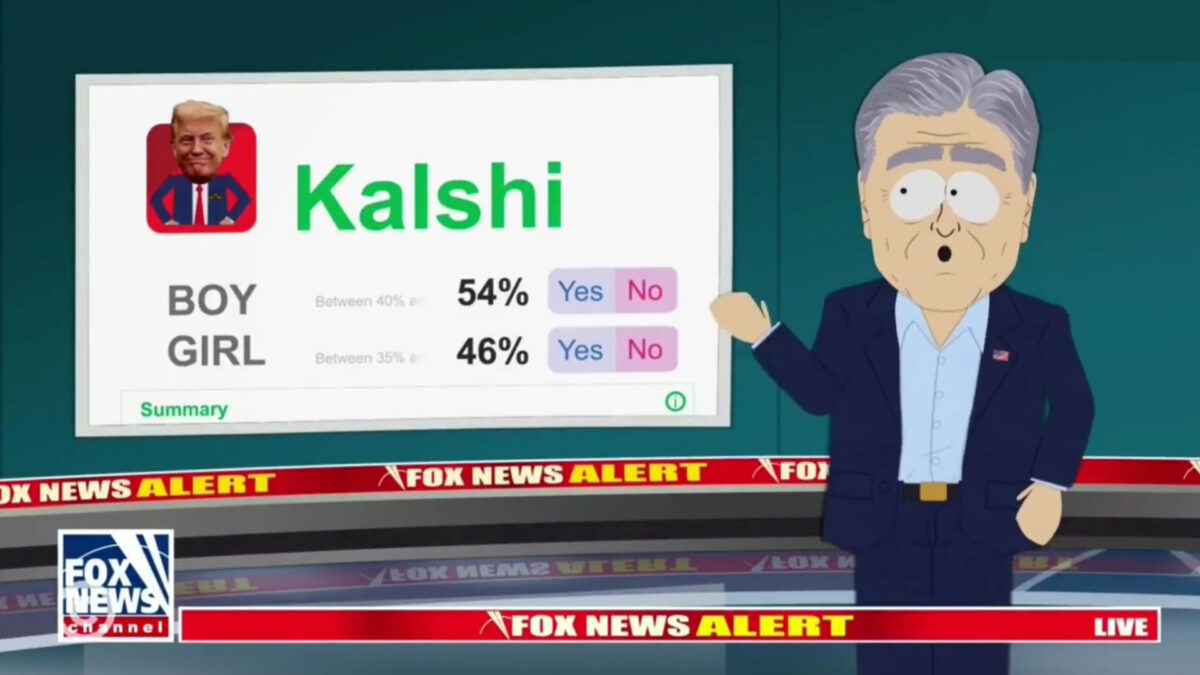

A prediction market is where people can trade contracts on the outcome of a real-world event that is yet to take place, generally with a yes or no answer.

It is effectively laying money against the answer to a question, such as whether a specific actor will win an Oscar or if a presidential candidate will be elected to office.

It is a peer-to-peer betting system where the price and eventual payout is determined by the number of people trading contracts on the event.

The full value of a contract is normally set at $1.

A single contract will cost a fraction of $1 and reflects the public’s thinking.

If an event contract is presently trading at $0.45, users up to that point believe there is a 45% chance of a ‘yes’ answer, and ‘no’ contracts would cost $0.55.

You can buy or sell contracts through the duration of that event.

If you trade on the correct outcome, your profit is the full value of the contract minus what you paid for it.

In the above example, if you bought a single contract for $0.45 on a yes outcome, the payout on the contract is $1.

Your profit is the final contract value ($1) minus your initial cost ($0.45) which in this case gives you $0.55 profit.

If you had purchased 10 yes contracts at $0.45 each, your profit would be $5.50.

If the outcome you backed doesn’t happen, you lose your entire investment.

The Row Over Regulating Prediction Markets

While the market is regulated nationally in the US by the Commodity Futures Trading Commission (CFTC), individual states continue to argue that laying money on the outcome of a sports event is basically sports betting and should therefore fall under state regulation.

Those arguments have spilled over into the courts with actions and counteractions.

Even satirical comedy South Park has been at odds with prediction markets, tackling the subject in its usual caustic manner in a recent episode titled Conflict Of Interest.

Kalshi, which has Donald Trump Jr as a Strategic Advisor, has so far contested actions brough by state regulators in Massachusetts, Nevada, New Jersey, Maryland, Arizona, Montana, Ohio, and Illinois.

When you hear some of the sums involved you can see why certain US states are after a piece of the pie.

Last month, Massachusetts Attorney General Andrea Joy Campbell filed a lawsuit with the familiar line that Kalshi was operating illegal sports betting without a proper license.

The complaint stated that in the first half of this year, Kalshi had processed over $1 billion in sports wagers from 3.4 million bets.

As things stand, local courts have been divided in their opinions on whether Kalshi is in fact offering sports betting.

Federal courts in New Jersey and Nevada have issued preliminary injunctions to prevent state regulators from attempting to enforce restrictions on Kalshi, but Maryland’s federal judge has given state regulators the green light to pursue their action.

While Kalshi is proceeding with its fight against ongoing litigation across multiple jurisdictions in the US it is continuing to operate nationally with federal approval.

Which Sports Betting Companies Offer Prediction Markets?

There has been a mixed reception to the rapid success of prediction markets from the big hitters in the US sports betting industry.

For the most part, sports betting companies are fidgeting nervously on the bench, wondering whether they should be taking part in the action or simply sitting things out.

- DRAFTKINGS saw its share price drop 0.75% after last week’s announcement regarding Kalshi’s expansion plans. CEO Jason Robins had appeared to dismiss the idea at the start of the month but on October 21 DraftKings acquired Railbird to advance its future growth in prediction markets. The plan is to develop and launch DraftKings Predictions on mobile, allowing its users to trade regulated event contracts on real-world outcomes across finance, culture, and entertainment.

- FANDUEL is on board and has allied with Chicago Mercantile Exchange with plans to launch FanDuel Markets by the end of this year. The Flutter-owned firm will operate at a federally regulated level and cover financial, leisure and entertainment outcomes but steer clear of sports for now until the regulatory landscape becomes clearer.

- BETMGM has no intention of entering the marketplace. CEO Adam Greenblatt confirmed during the firm’s Q3 earnings update: “Our position is clear and aligned with almost 40 state attorneys general, our regulators and our tribal partners. As the law stands today, sports prediction markets are, in essence, illegal sports betting.”

- CAESARS is keeping an eye on things. Eric Hession, president of Caesars Sports and Online Gaming, was asked about the firm’s stance in this week’s Q2 2025 earnings call. “I would say at this point, no updated views,” he said. “We’re actively watching the situation, and we’ll make sure that we’re not caught flat footed on that. There’s a lot more people objecting to it, but really nothing’s moved through the court system at this point.”

- PRIZEPICKS gained CFTC approval as a futures commission merchant in September. That will give it new opportunities to expand into prediction markets. That news arrived just as multi-national lottery firm Allwyn agreed to pay $1.6 billion for a majority stake in the fantasy sports operator.

What Does The Future Hold For Prediction markets?

Perhaps with a huge sense of irony, Polymarket has already opened a trade asking whether sports prediction markets will be banned in any US state in 2025.

With less than three months until the turn of the year, Kalshi is busy batting away cease and desist orders being filed by several US states while continuing to operate happily with the CFTC’s regulatory approval.

While there is this federal versus state impasse we don’t appear to be any closer to resolving the key issue, whether sports betting contracts are simply bets by another name.

FanDuel has dipped its toe in the water, but it is not yet planning to wade into the deep end of sports betting markets until there is a clearly defined and agreed system of regulation in place which is unchallenged in the courts.

That could be some time.

The general feeling in the US sports betting industry was expressed by American Gaming Association CEO Bill Miller, while delivering a keynote speech at last week’s Global gaming Expo.

“The AGA and our members are mobilizing across every battlefield,” he said, going on to explain that while legislated sports betting operators abide by rules that protect consumer’s rights and interests, as well as pay their way by contributing to state revenue through taxes, prediction markets have no such responsibilities.

“They want the opportunity, but they don’t want any of the regulatory compliance.

“And they really don’t care about their concern for the public good, but these illegal actors aren’t fooling anyone.”

Miller did not pull any punches in emphasising his point either.

“These operators have a word to describe what it means to ignore the rules, bypass the citizens, offer no community benefits, and tell customers it’s OK to lose your shirt.

“They call it innovation. I call it something else. It’s greedy, it’s reckless, and it’s irresponsible.”