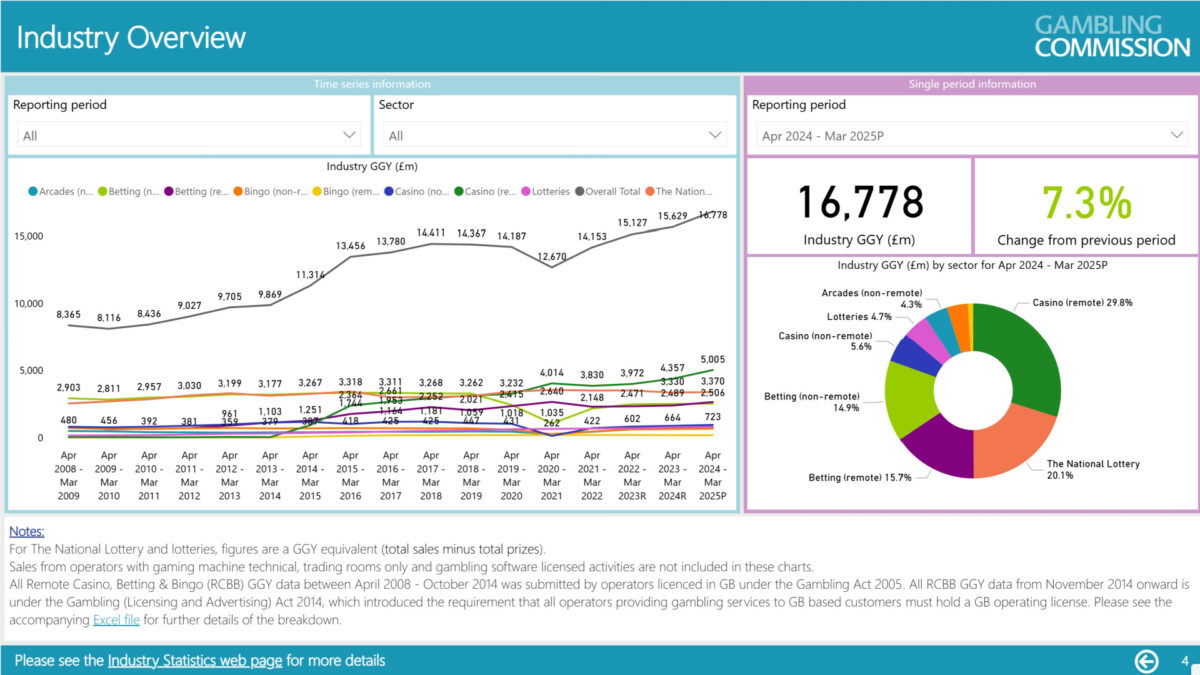

The British gambling industry has flourished over the last fiscal year, generating £16.8 billion after winnings had been settled, producing a healthy 7.3% increase in gross gaming yield year-on-year.

Those figures, revealed in the Gambling Commission’s industry statistics annual report for the financial year April 2024 to March 2025, will no doubt have landed on the desk of Chancellor Rachel Reeves and added more fuel to her fire as she plans to revise the system of how gambling companies are taxed.

Remote gambling made up 46% of the market in Great Britain, generating a gross gambling yield of £7.8 billion which was a jump of around £900 million (13.1%) on the previous 12 months.

Gross gaming yield (GGY) is the amount of revenue retained by gambling operators after they have paid out all winnings and prizes, but before operating costs have been deducted.

The land-based gambling sector had a 29% share of the market, contributing £4.8 billion and the remaining 25%, equating to £4.2 billion, came from the National and other licensed lotteries.

It was positive news in a week when the gambling industry is bracing itself for a tax hike in Reeves’ 2025 Budget.

Remote Gambling In Focus

Remote gambling incorporates online casinos, betting and bingo (RCBB) with all three areas combined producing £7.8 billion GGY from April 2024 to March 2025.

Breaking it down into the individual sectors, the returns were:

Online Casino Games: This produced the highest GGY with £5 billion, a 14.9% increase on the previous 12 months. From that overall figure a mighty £4.2 billion was generated by online slots, which accounted for 83.5% of the total GGY. Roulette made up 7.5% of the total.

Remote Betting: GGY totalled £2.6 billion, a hike of 10.9% on the same period in FY24, with the two main contributors being wagers on football, to the tune of £1.3 billion, and £766.7 million on horseracing.

Remote Bingo: The least productive sector by far, with GGY of £165.6 million, a small year-on-year drop of 1%.

Non-Remote Gambling

There was a 0.7% increase in non-remote betting GGY with £2.5 billion overall, though the number of licensed betting premises had dropped to 5,825, 106 fewer than existed in March 2024.

The popularity of online casino games was replicated in land-based premises through the fiscal year.

The non-remote casino sector generated £933.8 million GGY, an increase of £68.6 million (7.9%) on the previous year, with £702.4 million for casino games and £231.5 million from casino machines.

Bingo produced £650.4 million GGY, a 3.5% increase, with £424 million for bingo machines and £226.4 million for bingo games.

Arcades returned GGY of £723.3 million which was a 9% hike on the previous 12 months.

National And Other Licensed Lotteries

Sales of National Lottery tickets from March 2024 to April 2025 reached £7.9 billion, an increase of 0.8%, while prizes paid out totalled £4.5 billion.

A sum of £1.64 billion was contributed to good causes across community sports, arts and heritage projects.

Lottery Duty runs at 12% meaning Allwyn is liable for £944 million, while retailers’ commission came to £226 million.

Allwyn’s other costs and operating profit accounted for the remaining £557 million.

There was another £1.1 billion in sales of large society lottery tickets, 4.7% up year-on-year, with £316.3 million returned as prizes and $484.6 million allocated t good causes.

Summary Of The Key Facts

- £16.8 billion – That’s the total GGY for the gambling industry in Great Britain from April 2024 to March 2025, an increase of 7.3% on the previous 12 months.

- £12.6 billion – The total GGY excluding lotteries, a 9.3% rise.

- £7.8 billion – The total GGY for the Remote Casino, Betting and Bingo Sector, a 13.1% increase on FY24.

- £4.8 billion – The total GGY for land-based Sectors, comprising Arcades, Betting, Bingo and Casino, which was a 3.6% year-on-year rise.

- £2.6 billion – GGY for gaming machines in Great Britain.

- 8,234 – The number of licensed gambling premises in Great Britain, a 1.1% drop on previous.

- 5,825 – The number of betting shops operating in Great Britain, a 1.8% decrease on the period from April 2023 to March 2024.

- £1.6 billion – The sum allocated to good causes by The National Lottery.

- £484.6 million – Contributions to good causes from large society lotteries.

- 2,179 – Gambling operators in GB’s market, a 3.7% decrease on the previous 12 months.

- 3,086 – Licensed gambling activities as of March 31, 2025.

Gambling Tax Rise Expected In The Budget

Reeves is expected to announce new tax measures for the gambling industry in her 2025 Budget to be delivered on Wednesday, November 26.

At present there is a three-tier system for remote gaming, machine games duty and general betting, with rates fluctuating between 5% and 21%.

Proposals under consideration could see the Labour chancellor introduce a single remote gambling tax to harmonise those three tiers.

That would also give her an opportunity to impose a higher rate of tax as the government looks for ways to raise funds to tackle social issues such as child poverty.

The Institute for Public Policy Research has suggested amending gambling taxes to split levels of 50% and 25% which would generate an estimated £3.2 billion, while the Social Market Foundation suggested online tax reform believes £2 billion could be raised by increasing Remote Gaming Duty to 50%.

The UK’s Betting & Gaming Council has been actively lobbying against such a move and published a report warning that a betting tax hike could see businesses lose out to the offshore market.

A spokesman for the BGC said: “The headline growth in the betting and gaming industry masks a mixed picture.

“While some products have expanded in response to customer demand, land-based operators including betting shops have faced a real-terms contraction, with over 30 closures this quarter.

“BGC members generate £6.8 billion for the economy, contribute over £4 billion in tax and support 109,000 jobs, while sustaining local economies and sports.

“Ministers should take care in the Budget not to impose measures that weaken the regulated sector and strengthen the unsafe, unregulated gambling black market, which pays no tax and offers none of the protections that exist in the regulated sector.”