The UK Betting & Gaming Council (BGC) has launched its latest volley towards Chancellor Rachel Reeves in an attempt to encourage an urgent rethink over proposed gambling tax hikes in November’s Budget.

The BGC has already championed the cause for the gambling industry by warning of potential betting shop closures and job losses should new measures be introduced.

An appearance in front of the Treasury Committee last month didn’t go as planned though, after CEO Grainne Hurst drew criticism from the Treasury chair, Dame Meg Hillier MP, who said she was ‘flabbergasted’ by Hurst’s refusal to accept that the gambling industry created social harms.

The BGC has now upped the ante with its latest warning that the UK could go the same way as other highly legislated countries around Europe such as France, where tightening the grip over the gambling industry has led to an exodus of businesses and consumers turning to offshore operators.

The fuel for its fire has come in the form of research published today (Monday, November 10) which the BGC commissioned from Pricewaterhouse Cooper (PwC).

When Is Labour’s Next UK Budget?

There is a real threat of an increase in gambling tax duties in the Budget which Reeves will announce on November 26.

Speaking at September’s Labour Party conference, she signalled her intention by stating that gambling operators “should pay their fair share.”

Several big names on the UK’s high streets have spoken out against such a move.

Fred Done, Chairman and co-founder of Betfred, recently fired a warning that 7,500 jobs would be at risk if tax rates increased, while Flutter-owned Paddy Power said their recent shop closures could be the first of many for the UK betting trade.

While there is a feeling among Labour MP’s that this is merely scaremongering by the industry bigwigs, the BGC feels it now has the hard evidence to justify maintaining betting tax levels at their existing rates.

Losing Consumers To Offshore Operators

The new PwC report highlights the potential impact of increased tax and regulation on the UK betting and gaming market by assessing the evidence gathered from 17 European jurisdictions that are comparable to the UK.

Among its more damning conclusions from the 67-page document, the BGC points to the examples of France, Sweden and Spain as previously flourishing gambling marketplaces that have subsequently seen a shift of business to offshore operators following the introduction of restrictive legislative policies.

This is a problem because offshore operators can exist outside of local legislation and therefore do not contribute towards a country’s tax revenues.

In France’s case, the study shows that 57% of the market now belongs to the offshore companies, while the Netherlands (37%) and Sweden (35%) have also lost a large portion of their gambling market.

It is a very different picture in countries such as Spain and Denmark, where tax rates are moderate and licensing not so rigid.

They both have a much bigger share of the overall gambling market with just 11% of business being conducted by the offshore sector.

Conclusions Of The BGC’s Report

Other top lines from PwC’s study on the impact of the taxation and regulatory environment on European online betting and gaming markets include:

- Between 2019 and 2024, countries with tax rates below 25% of gross gaming revenue saw annual growth in tax receipts of 13%, compared to 9% in higher-tax jurisdictions.

- Around 5% of all online betting and gaming in the UK takes place on unlicensed websites. This is already a considerable hike from the 3.3% estimated in 2021 and would increase further if heavier tax burdens were to be introduced.

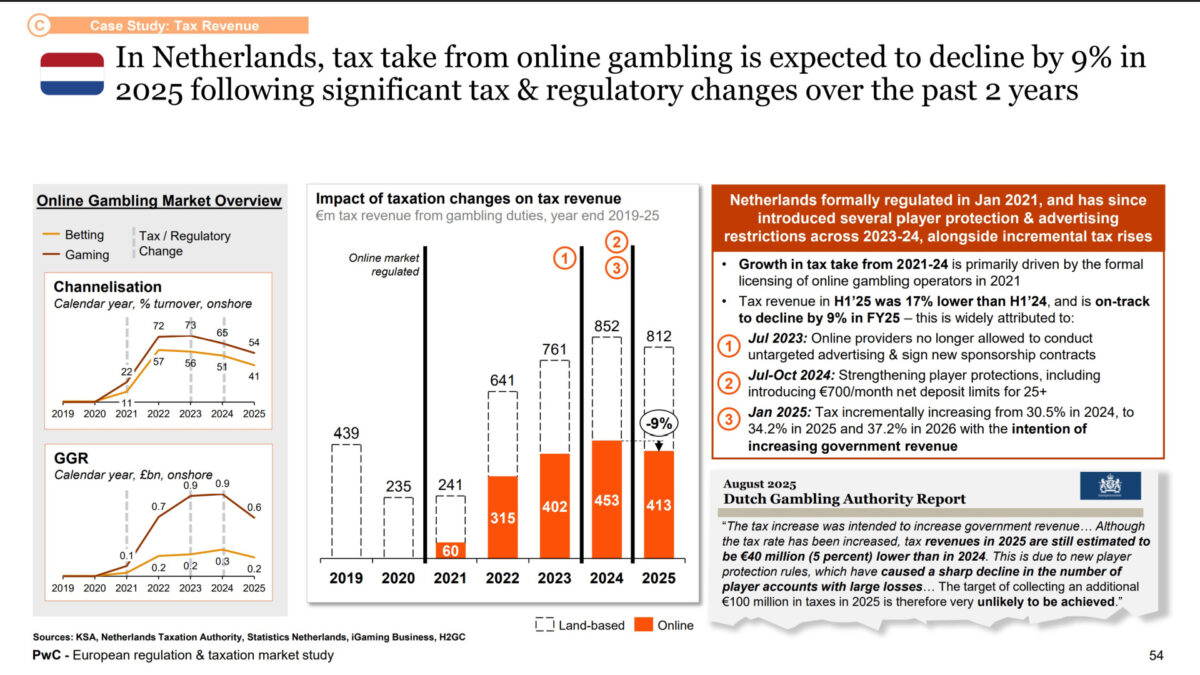

- In the Netherlands, tax take from online gambling is expected to decline by 9% in 2025 following significant tax and regulatory changes over the past two years.

- Over the past five years, tax revenue grew faster in jurisdictions with average gambling tax rates up to 25% versus jurisdictions with higher tax rates.

- Operators facing steeper duties typically cut back their spend on marketing and promotions, making licensed platforms less competitive in the face of offshore alternatives.

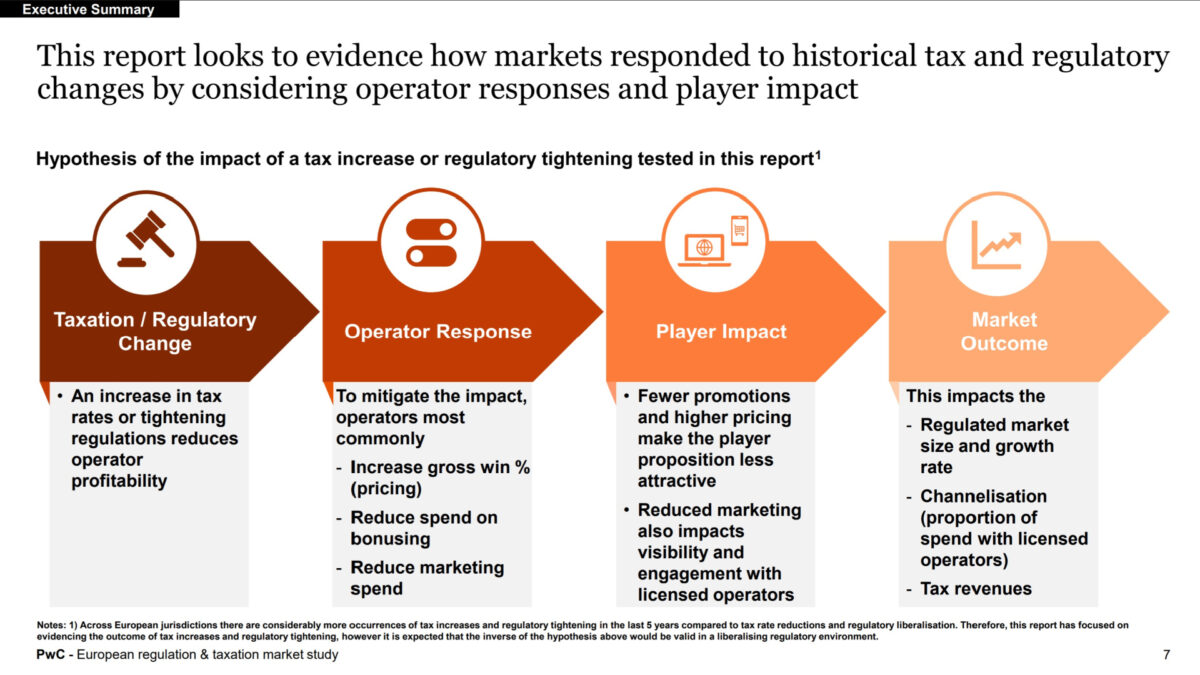

- Operators respond to higher regulatory and tax environments by adjusting gross win pricing, reducing bonuses and reducing spending, which makes the player proposition less attractive.

Executive Comment

Grainne Hurst, CEO of the BGC: “Britain has one of the safest gambling markets in Europe but if the Treasury isn’t careful, we could quickly end up like France or Sweden, with huge black markets contributing nothing in tax, offering zero player protection, and providing no funding for sport or the economy.

“Well-balanced regulation and fair taxes protect players, raise more revenue for the Treasury, and support thousands of jobs. Unlicensed operators do none of those things.”