All the speculation around a rise in UK gambling tax duties will end on Wednesday (November 26) with the announcement of Labour’s Budget by Chancellor Rachel Reeves.

It certainly seems to have moved beyond “if” a rise in betting company duties and levies will be introduced and more a case of “how much will they be?”

There has not been much sympathy for market leaders in press coverage leading up to the Budget.

Over the weekend, a report in the Guardian stated UK gambling firms spent an ‘astronomic’ £2 billion on advertising last year and quoted Labour MP Alex Ballinger as saying: “Perhaps gambling firms should think about cutting back on adverts that nobody wants to see before pushing back against paying fair taxes on their vast profits particularly given the harms they cause.”

Pressure Intensifies As Budget Draws Closer

Just last week, both Prime Minister Sir Keir Starmer and former PM Gordon Brown ramped up expectation that a UK gambling tax hike will happen during interviews on national TV.

Brown in particular addressed the proposal of generating more coffers for the Treasury to tackle social problems by increasing gambling tax levies.

In late October, two senior members of the UK’s Betting & Gaming Council (BGC) appeared before a Treasury Committee to present a case against a potential tax hike.

It did not go well, with CEO Grainne Hurst drawing criticism from Treasury Chair Dame Meg Hillier MP for saying she didn’t think it was right “to categorise the gambling industry as creating social harms.”

What Are The Preset Rates Of UK Gambling Tax?

In the UK you do not have to pay tax on your gambling winnings, the burden is placed on the operators.

There are three basic rates of duty which bookies and casinos are subject to:

Remote Gaming Duty: This stands at 21% on the profit earned from online games of chance.

Machine Games Duty: There are three rates applicable here. The lower rate is 5% and is for machines where the cost to play is 20p or less and the top prize is capped at £10. The standard rate is 20% where the cost to play is between 21p and £5 where the top prize is over £10. The higher rate is for machines where each play costs £5 or more, regardless of the value of the top prize.

General Betting Duty: A bookmaker’s profits from sports wagers on the likes of football, horse racing and dog racing are taxed at 15% if made by a customer in a betting shop or a UK customer online. Non-financial spread bets are subject to a 10% tax rate.

What Is The Likely New Legislation?

The proposal under consultation is to introduce a single remote gambling tax to harmonise the existing three-tax system and to make that tax above present levels in order to generate funds to tackle social issues.

The Institute for Public Policy Research estimated that £3.2 billion could be raised to help reduce child poverty by amending gambling taxes to split levels of 50% and 25%, while the Social Market Foundation suggested online tax reform that could generate £2 billion by increasing Remote Gaming Duty to 50% while keeping horseracing as a separate entity at lower levels.

Gordon Brown has compared the UK’s remote rate of 21% with the much higher rates charged in other European countries and some states in the US.

In his proposals to government consultation recommending a tax on gambling, Brown wrote: “Remote Gaming Duty is around 40% in Holland and Austria, and over 50% in many US states where it is legal, such as Pennsylvania.

“In Delaware, which has a reputation for being a tax haven, the tax rate for online casino gaming is 57%.

“In the UK online gaming is taxed at just 21% raising only £2.5 billion, even though remote gaming yields have grown by 40% after inflation in 10 years.

“Applying a 50% levy – much less than the 80% tax on cigarettes sales and the 70% tax on whisky – would raise around £1.6 billion, and raising General Betting Duty from 15% to 25% could raise an additional £450 million.”

Reaction From The Gambling Industry

There have been two main camps pushing back against any increases in UK gambling taxes, the gambling industry and the horseracing industry which has been fighting its own battle.

The British Horseracing Authority launched several protests and cancelled a day’s racing in September under its #AxeTheTax campaign which included a march on Westminster.

That was followed up in October with 363 industry professionals signing an open letter asking the Chancellor for a tax rethink.

There is a strong feeling that these may have had some affect and that horseracing will not be included within any major revisionary measures to be revealed on Wednesday.

Among the gambling industry’s big players, Sky Bet and William Hill made some major financial moves under the cloud of a UK gambling tax hike.

Sky Bet’s parent company Flutter has moved its headquarters from London to Malta, a strategic decision which has been estimated could save the firm £55 million in UK tax payments.

The news sparked a reaction from Brown who asked MPs on the Treasury Select Committee to explore whether such an action was a loophole open to be exploited in UK tax law.

From December 2, William Hill is withdrawing its online operation from 13 countries across Africa, Latin America and Asia, just a week after it will have learned what new tax measures may be coming into force in the UK.

Several of the leading betting operators have been “scaremongering” according to Labour MPs, among them Betfred, which warned that 7,500 jobs would be at risk from its own organisation and Paddy Power, whose recent shop closures could be the first of many for the UK betting trade.

Stella David, CEO of Entain which operates both Ladbrokes and Coral, has also warned that a gambling tax rise could lead to high street betting shop closures.

Final Stand By The BGC

At September’s Treasury Committee meeting, there was a feeling that the BGC officials had been ambushed as they had to listen to speakers who were in favour of increased tax levies before speaking against them.

Chair Hillier introduced them by saying: “You had a bit of a roasting there from the people who feel that gambling should be more taxed.”

One of the panel in favour was Stewart Kenny, a co-founder of Paddy Power in the 1980s, who was particularly critical of betting companies that offer free spins on their casino products to customers who had initially engaged in sports betting.

“This is taking somebody from the least addictive product to the most addictive product,” he said.

While the post-meeting publicity shone a critical light on Hirst’s refusal to accept that the gambling industry created social harms – with ‘social harms’ being the key justification behind Labour’s plans to hike gambling taxes – the official body flagged up another major concern earlier this month.

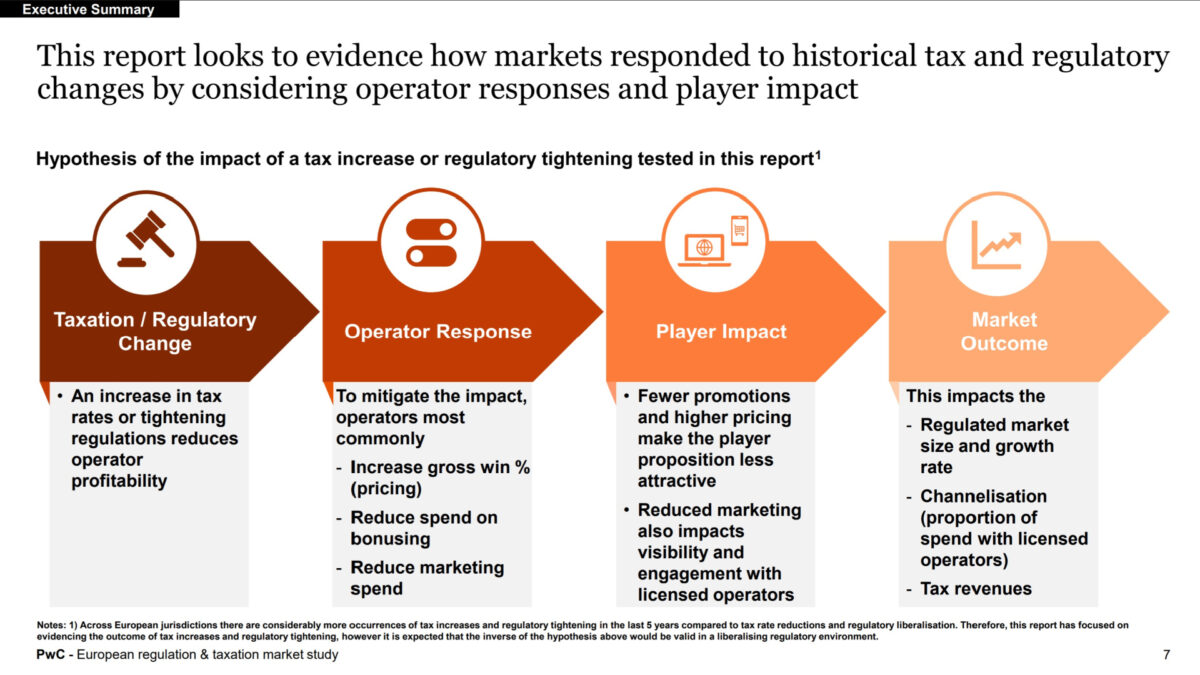

A report commissioned by the BGC concluded that a betting tax hike could see businesses lose out to the offshore market.

The 67-page document cited the markets in France, Sweden and Spain where flourishing gambling industries have witnessed customers shifting to offshore operators following the introduction of restrictive legislative policies.

Hurst concluded: “Britain has one of the safest gambling markets in Europe but if the Treasury isn’t careful, we could quickly end up like France or Sweden, with huge black markets contributing nothing in tax, offering zero player protection, and providing no funding for sport or the economy.”

All the noise coming from MPs in favour of a tax hike would suggest that the BGC and the gambling industry in general should not bet on a favourable outcome from Reeves’ Budget on Wednesday.