Flutter has emerged from Italy’s crackdown on online gambling in a position of strength, as it looks to limit the damage caused by India’s mid-year ban on all online games played for real money.

The global gambling and gaming operator, whose stable of betting brands includes FanDuel, Paddy Power, Betfair and Sky Betting & Gaming, reported a Group net loss of $798 million in its Q3 2025 earnings release.

It was also coming to terms with having to implement a series of Paddy Power shop closures, with 57 retail outlets being shuttered after a review of the UK and Ireland operator’s estate.

A large portion of that third quarter net loss was down to India’s real-money gaming ban that was rushed through government in August, resulting in Flutter having to hastily withdraw its Junglee brand from the market.

It was a swift and brutal blow to the firm’s ambitions for the region and cost the Dublin and New York-based operator $556 million in impairment charges.

It also took a large chunk out of its original projection for Junglee which it had anticipated generating $200 million revenue through 2025.

Flutter’s Strategic Moves In Italy

Italy has become Europe’s largest gambling market having overtaken the UK in 2024 with gross gaming revenues of €21.5 billion.

A major revision of gambling legislation in Italy has seen the number of licensed operators reduced from 407 in October to just 46 last week, after a purge on skin websites.

‘Skins’ in the world of online gambling are multiple affiliate sites running on the back of one operator license.

Flutter is now one of the few operators that runs multiple brands in the country, overseeing Betfair Exchange, local acquisition Snaitech (SNAI) and leading Italian online gaming operator Sisal, as well as PokerStars and Tombola.it.

For the third quarter of this year, Flutter’s Southern Europe & Africa division reported a 24% increase in organic iGaming revenue, with Sisal being one of Q3 2025’s big success stories recording online growth of 46%.

Flutter acquired Sisal, one of Itay’s leading online gaming operators, in a deal worth around €1.913 billion in 2021.

In April this year Nasdaq announced Flutter Entertainment had completed the Acquisition of Snaitech for €2.3 billion, expanding its presence in the Italian market still further.

Flutter CEO Peter Jackson confirmed that the company had implemented several strategic moves in Italy to support its flourishing titles, including the introduction of MyCombo, Flutter’s same game parlay (SGP) product.

“In Southern Europe and Africa (SEA), we launched MyCombo on Sisal, the only full SGP product available in the Italian market, in time for the start of the Italian soccer season,” Jackson said.

“Customer engagement has been strong with half of customers placing a MyCombo bet during the first seven rounds of the season.

“The September integration of Flutter Studios into the SEA Italian online platform has enabled inhouse content to be offered to our Italian customers, with a strong pipeline of future content.

“In July, we migrated PokerStars Italian customers to our SEA platform, a key milestone in the PokerStars transformation which will deliver material savings in 2027 after completion of the final migration from the existing PokerStars technology stack.

“The SNAI integration has been progressing well; we have enhanced the iGaming proposition, optimized retail gaming machines and commission structures, and increased customer acquisition volumes by deploying Sisal’s proven retail signup program.

“The migration of SNAI customers to the SEA online platform remains on track for H1 2026, providing increased confidence in our SNAI synergy targets.”

Uncertainty Around UK Gambling Tax Laws

While still licking its wounds from the sudden collapse of the online gambling market in India, Flutter is bracing itself for a potential hike in UK gambling taxes.

Chancellor Rachel Reeves has been considering a revision of gambling tax levies as a way of generating funds to help tackle child poverty.

Her Budget is due to be revealed on November 26 and just last week Prime Minister Sir Keir Starmer and Gordon Brown both ramped up expectation that a UK gambling tax hike will happen.

Jackson attempted to calm any fears when announcing the firm’s quarterly figures.

“There has been much speculation around potential gaming tax increases in the upcoming UK budget,” he said.

“We remain engaged with policymakers and expect decisions will be based on economic merit, taking into account the industry’s substantial contribution to UK tax revenues and employment.”

Others in the UK gambling industry have not been so optimistic, with Ladbrokes and Coral owner Entain declaring that a gambling tax rise could lead to betting shop closures and Betfred firing a warning that 7,5000 jobs would be at risk.

Entering The Prediction Markets Space

One hugely anticipated move for Flutter in the US is FanDuel’s entry into the prediction markets arena.

In August, Flutter announced that CME Group and FanDuel had partnered to develop an innovative event contracts platform in the form of a bespoke branded app.

FanDuel Predicts is expected to launch in December and will include sports event contracts in the US states which do not yet have regulated access to sports betting.

“We believe this new sports opportunity lies solely in these states,” said Jackson, “as prediction markets are having a negligible impact in the states where FanDuel sportsbook is already available to customers.”

Jackson also confirmed that the launch strategy has been “developed in close consultation with state regulators and tribal authorities, resulting in a tailored, state-specific approach”.

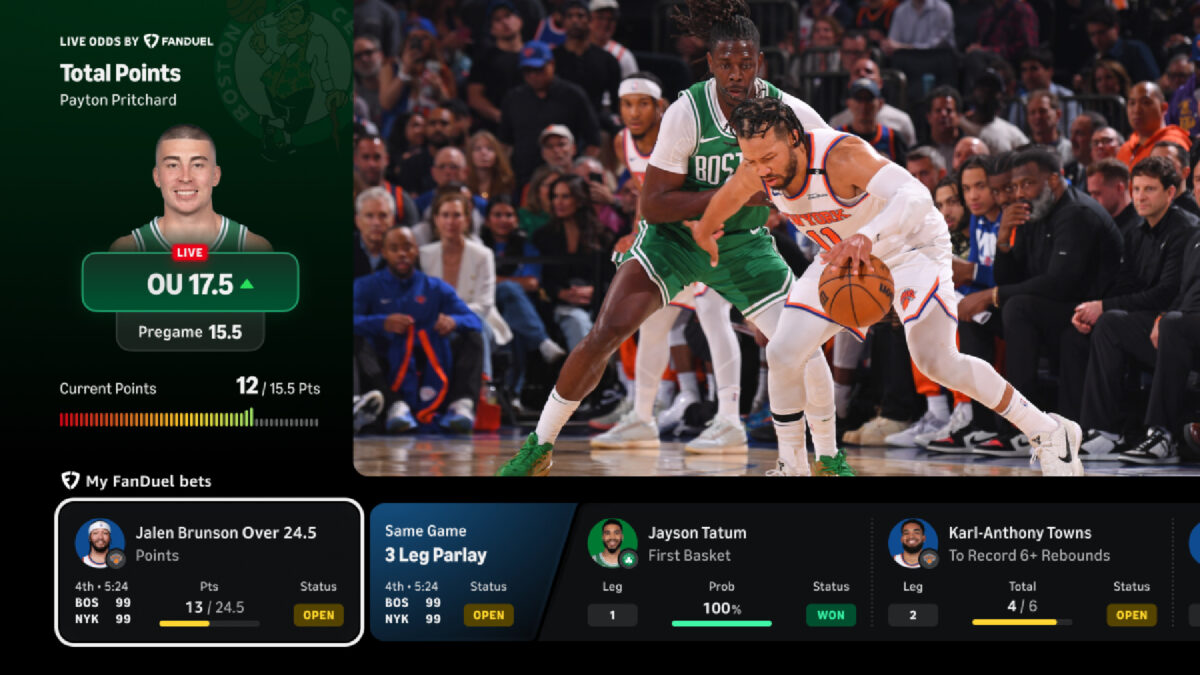

Another major play for the final quarter of 2025 is that FanDuel betting tools now feature in live NBA coverage through Amazon Prime.

The 11-year global media rights deal tipped off on October 24 and saw the activation of an opt-in live bet tracking and odds view service delivered in-screen during Prime’s coverage, powered by FanDuel’s sportsbook.

Bet Tracking does not offer the ability to place bets directly on Prime Video, as wagering continues to operate through the FanDuel app.

What happens over these next few weeks will give us a strong indication of how Flutter Entertainment will fare through 2026.

While the threat of punitive tax levies in the UK looms large, we will have to wait until the Budget announcement on November 26 to assess whatever the long-term effect may be.

The strong investment in Italy and entry into prediction markets in the US ahead of many of its rivals could be robust revenue drivers in the new year.