William Hill owner evoke has announced a fifth consecutive quarter of year-on-year revenue growth, posting £435 million for July through to the end of September, a 5% increase on the same period in 2024.

It is significant progress at a time when the betting industry as a whole is wary of the up-coming November budget in the UK, where Chancellor Rachel Reeves is expected to make some significant changes to gambling tax laws.

Delivering its Q3 2025 trading update, evoke attributed part of its success to a return to growth in Retail, which meant that all three of its divisions had posted revenue increases for the quarter.

Evoke is the parent company of William Hill, 888 and Mr Green and the group gave a positive message to its investors by reiterating its full year 2025 guidance of achieving adjusted EBITDA margin of at least 20%, which it feels would put it ahead of present market expectations of £362 million.

Gambling Industry Threatened By Tax Hike

That optimistic outlook did not include any reference to a potential gambling tax hike which could severely offset positive projections.

The Chancellor is expected to bring in one harmonised tax rate for online gambling when she reveals her budget on November 26, by establishing a new Remote Betting & Gaming Duty.

That has prompted a backlash from the betting industry with many leading brands warning of potential shop closures and job losses from any increases in gambling tax duties.

Evoke was one of those dissenting voices, saying that between 120 and 200 William Hill betting shops may have to cease trading if a tax increase is imposed, with up to 1,500 jobs at risk.

Flutter-owned Paddy Power said their recent shop closures could be the first of many for the UK betting trade if Reeves proceeds with the proposal, while Betfred warned that 7.500 jobs could be at risk due to a gambling tax hike.

Earlier this week, British horseracing united with 363 prominent figures from the industry signing a letter asking the Chancellor for a tax rethink.

Revenue Increases For All Divisions In Q3 2025

While the industry waits nervously for Reeves to reveal her hand, evoke can at least celebrate the positive momentum that all three of its divisions exhibited during Q3 2025.

The International division led the way with a 6% increase, contributing £150.4 million, Retail enjoyed a 5% bump up to £121.7 million while its UK & Ireland Online business remained the primary source of revenue but just tipped over the line with a 1% rise to £163.3million.

CEO Per Widerström confirmed that the company’s present strategies were helping the firm’s “long-term competitive capabilities” which will lead to a more efficient and profitable business.

Retail was boosted by the rollout of new gaming cabinets at the start of this year and demonstrated a 6% rise in both betting (£67.1 million) and gaming (£54.6 million) revenues for the quarter.

In the UK & Ireland Online division, there was an 8% increase in betting revenue but that was offset by a 2% drop in gaming’s return.

Evoke pointed the finger at 888’s performance where it has reduced marketing spend to target higher market returns.

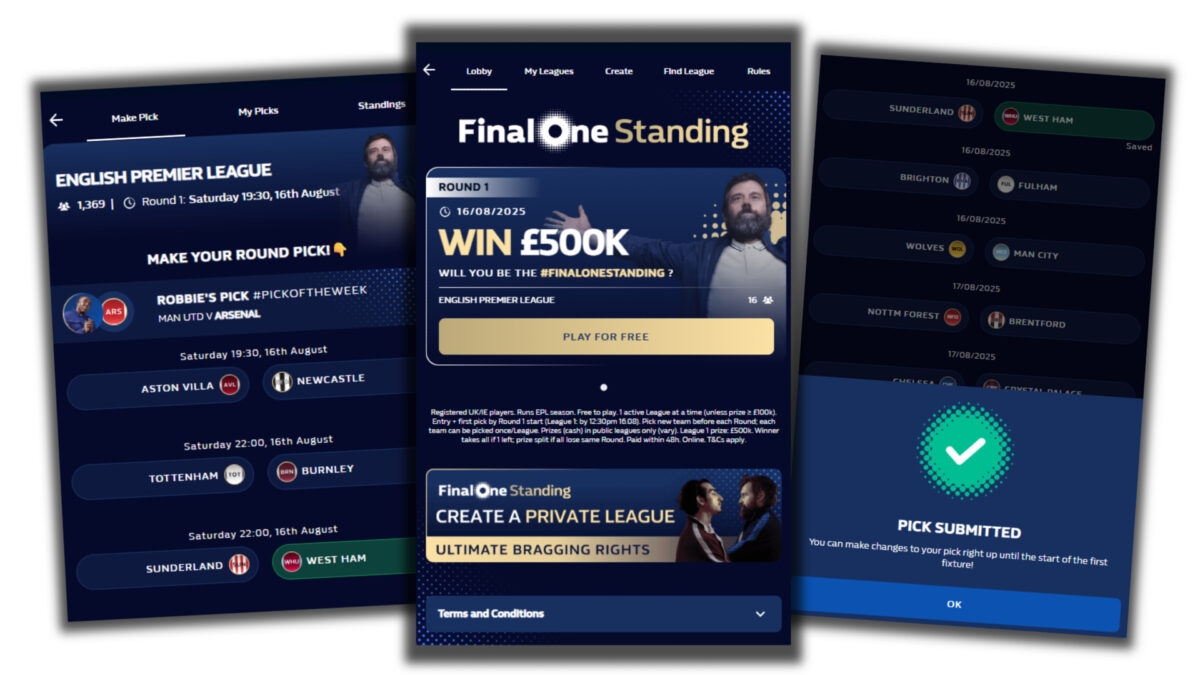

A big win came with the start of the football season, as William Hill launched a free to play game Final One Standing, which had attracted over 300,000 entries in the first week, boosting engagement and with a strong conversion to cash activity.

A new omni-channel product, Acca Boost, also delivered strong growth in football accumulator business across online and retail.

International revenue witnessed double-digit growth in Italy, Denmark and Romania, though Spain lagged behind its usual levels.

Evoke’s Positive Outlook For FY2025

“With Retail continuing the improving trend from Q2, all three divisions were in growth during the quarter”, said Widerström.

“Whilst our refined approach to UK Online marketing to drive improved profitability slightly held back our top-line performance, we are pleased to have recorded our fifth consecutive quarter of profitable growth.

“We have clear plans in place to support an improvement in revenue during Q4 through continued acceleration in product enhancements, including retail sports and our recently launched new William Hill Vegas app.

“We are also making ongoing improvements to our customer lifecycle management capabilities.

“Alongside this, the improvements we have made to the operating model and efficiencies in our cost base mean we remain confident of achieving our implied Adjusted EBITDA guidance, which would outperform market expectations.

“We continue to execute our turnaround with vigour and are making good progress against our plans to position evoke for longterm success and significant value creation.”