The British Horseracing Authority has published an open letter to Rachel Reeves signed by 363 professionals within the industry, asking the labour Chancellor not to introduce a proposed tax hike in November’s budget.

The sports betting industry has already been unified in its response to government plans for a range of gambling tax increases, with Betfred firing a warning that 7,500 jobs would be at risk and Flutter-owned Paddy Power saying their recent shop closures could be the first of many for the UK betting trade.

The government has been reviewing possible increases in gambling tax duties as a means of raising finance to tackle child poverty.

That would include the tax on bets made for horseracing online increasing from 15% to at least 21%, a move which the BHA estimates would see £66 million being lost to the horseracing industry within the first year, and also 2,700 jobs around the rural communities being put at risk.

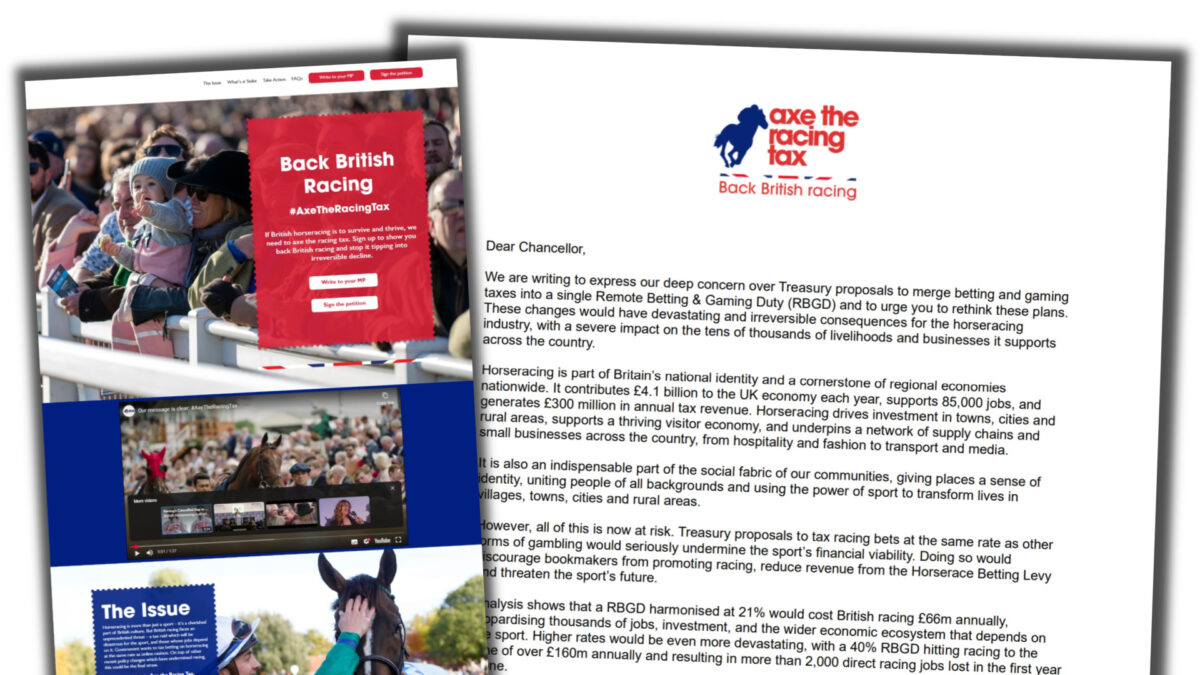

In an unprecedented move, 363 professionals from within the industry have signed the open letter to the chancellor asking the government to #AxeTheRacingTax – the slogan for the campaign.

What Is The Gambling Tax Threat To Horseracing?

The Chancellor has been consulting on measures that would replace the present system of three separate taxes for remote gambling with a single harmonised Remote Betting & Gaming Duty (RBGD).

At present the gambling industry is subject to a 21% tax on online casino game stakes while there is a general 15% betting duty for online sports betting, which includes horseracing.

The BHA has said that even a 6% rise to bring tax in line with the 21% for online casinos would be financially devastating and that doesn’t take into consideration that the overall tax limit could be increased from 21% to anything up to 50%.

A separate website was launched to back the AxeTheRacingTax campaign and on September 10 racecourses around the country fell silent as the industry staged a day’s protest.

As a part of that day’s action, there was a march on Westminster by a collective that included trainers, jockeys and officials.

Speaking at the time, acting CEO of the BHA, Brant Dunshea, outlined why the industry was so concerned about the introduction of a harmonised tax in the form of the RBGD.

“Our racehorse owners fear this Government proposal because it will make our racing a less competitive product and further reduce their return on investment making France and Ireland more attractive to them than Great Britain to race their horses,” he said.

“Our bloodstock industry, breeders, trainers, and Jockeys fear it because they depend on our owners.

“Our racecourses and the thousands of people who depend on them for work fear it because they fear for their futures, and reasonably so.

“The betting industry fears it because betting and horse racing are symbiotic.

“This symbiosis is unique.”

BHA’s Open Letter To Chancellor Rachel Reeves

In its AxeTheRacingTax open letter to the Chancellor, the BHA expresses its concern over the “devastating and irreversible consequences” for horseracing should her budget, due to be revealed on November 26, include any kind of rise in taxes for online betting on horseracing.

Among the 363 signatories are Flat trainers Andrew Balding, John and Thady Godsen and William Haggas and Jump specialists Dan Skelton, Paul Nicholls and Jonjo and AJ O’Neill.

Jockeys include Oisin Murphy, Sean Bowen and Tom Marquand.

The letter outlines how much the horseracing industry already contributes to the UK economy, some £4.1 billion, supporting 85,000 jobs and generating £300 million in annual tax revenue.

It goes on to warn how much would be lost to the industry should the present 15% limit be brought into line with the online casino rate of 21% or indeed increased to anything higher.

The letter reads: “Analysis shows that a RBGD harmonised at 21% would cost British racing £66m annually, jeopardising thousands of jobs, investment, and the wider economic ecosystem that depends on the sport.

“Higher rates would be even more devastating, with a 40% RBGD hitting racing to the tune of over £160m annually and resulting in more than 2,000 direct racing jobs lost in the first year alone.”

It concludes by explaining just how far and wide racing’s influence reaches and the damaging effect that would follow any tax rise.

“From trainers, breeders and stable staff to racecourse employees, hoteliers, local pubs, taxi drivers and small independent fashion shops, racing is indispensable to local economies in rural areas and towns in every corner of the UK.

“The proposed changes would irreversibly damage this, destroying our businesses, hollowing out local infrastructure, and putting at risk thousands of good, local jobs in parts of the country where alternative opportunities are often limited.

“The government’s proposals would do lasting damage to a major British industry, harm rural communities, and carry serious unintended consequences.

“It is not too late to rethink the approach and we strongly urge you to do so.”