While the debate around the legitimacy of sports prediction markets will stretch into 2026, and perhaps even beyond, it has proved to be the hot topic in the room as major players in the US sports betting industry have been presenting their quarterly trading reports.

This week has seen BetMGM and its brand owner Entain quizzed for their thoughts in their Q3 2025 earnings calls, while shareholder owned Caesars Entertainment was also asked to confirm its position.

The question that nobody has yet established a firm answer to is whether trading on sports contracts actually constitutes sports betting.

Trading on contracts is federally regulated, sports betting falls under state governance and the argument that financial platforms such as Kalshi should be subject to the same legislative oversight as betting companies continues to be fought in the courts.

There are 17 US states that presently do not allow online sports betting, but Kalshi is available in every one as in the eyes of federal law it is not a gambling company.

Sports prediction markets exceeded $2 billion in trading volume at Kalshi in the first half of this year and the firm recently went global, rolling out to over 140 countries after raising $300 million from a funding round.

The only certainty we have right now is that it is almost impossible to say what will happen next with prediction markets in the US, which is why a common theme cropping up in this week’s earnings calls has been: ‘Do you play, or do you fold?’

BetMGM

BetMGM CEO Adam Greenblatt has been quite vocal of late, stating that regulated companies operating in online gaming have found their hands tied because trading sports prediction markets is illegal sports betting in the eyes of the firm’s regulators.

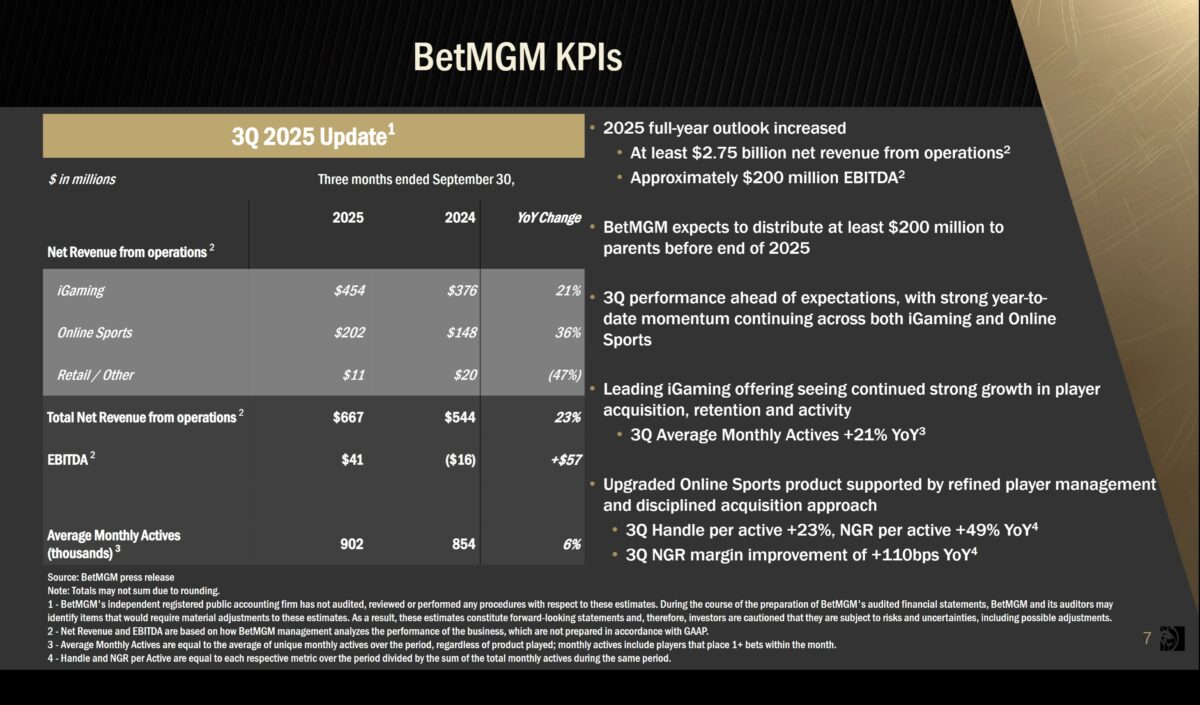

Bill Hornbuckle, CEO and President of MGM Resorts expanded on that in Wednesday’s earnings call, as the firm revealed its third quarter 2025 financial and operating results.

Hornbuckle asserted that while the long-term legislative landscape may be unclear, BetMGM’s position is very much aligned with the nation’s state governors.

“I want to follow-up on BetMGM’s recent comments about prediction markets,” he said.

“For decades, the gaming industry has been highly regulated at state level.

“This intense scrutiny has been essential to ensuring the integrity of the gaming industry and in the case of sports betting, help to identify potentially irregular activity.

“This is not the time to back away from these high standards.

“Gaming historically has been and should be continued to be a highly regulated industry with safeguards in place to protect consumers and promote integrity.”

Entain

BetMGM is co-owned by MGM Resorts International and Entain, which also houses UK sports betting giants Ladbrokes and Coral among others.

After presenting Entain’s 2025 Q3 trading update, CEO Stella David took time out of the group’s earnings call to address the prediction markets conundrum.

“I think Adam [Greenblatt of BetMGM] gave a very fulsome answer to the challenge of prediction markets in the US.

“We essentially believe that it is illegal, and with the regulators that we have to have a relationship with and be licensed through, we are not entering that market.

“I think he gave a very clear answer to that question.

“I think about the bigger question about prediction markets in other parts of the world, we’ve had things like Betfair in the UK, which is an exchange, so it’s not necessarily totally new, this concept, it’s similar.

“In a regulated market, Sportsbook offering is highly superior in my view to what prediction markets are currently offering.

“That’s not to say we shouldn’t be constantly innovating and looking for new things for customers to be engaged with.

“If there is a new feature that makes sense to them, clearly we would lean into that.”

Caesars Entertainment

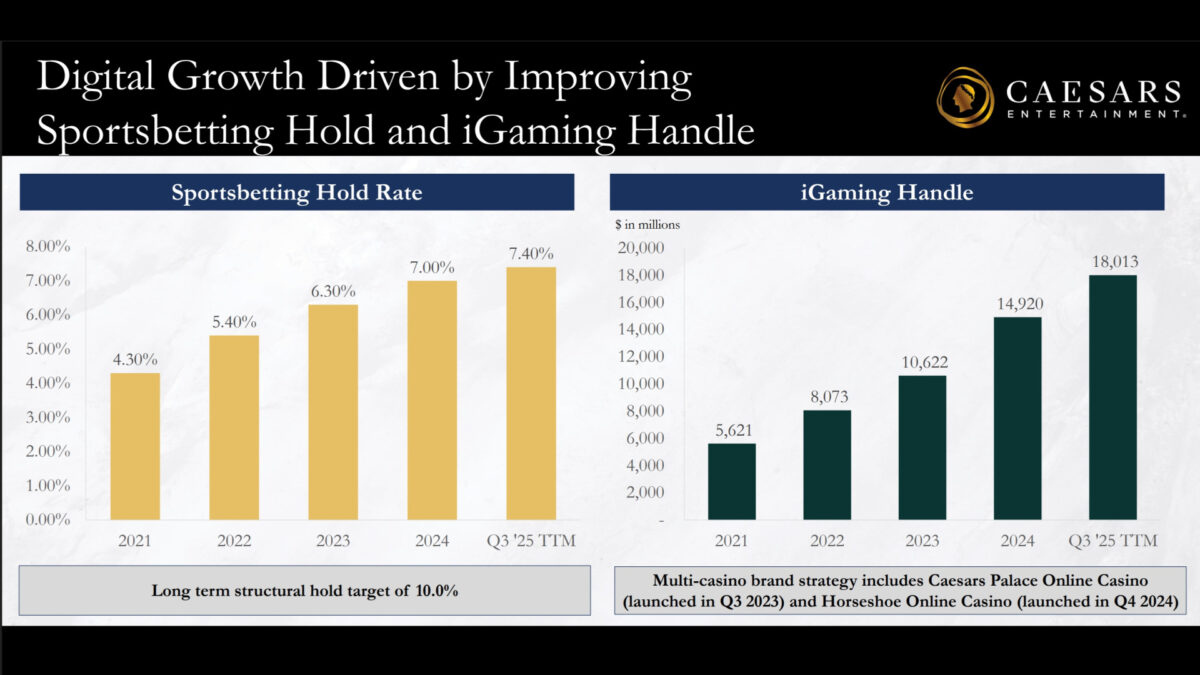

In Caesar Entertainment’s report for the third quarter of 2025, results showed online sports betting handle had risen by 6% with iGaming revenue up by 29%.

As such, Eric Hession, the President of Caesars Sports and Online did not feel its business was feeling the pinch of competition from emerging prediction markets.

“So far, we haven’t seen any impact,” he said.

“I suspect most of the volume that they’re generating is coming from states that don’t have legalized sports betting.

“And then there’s probably some on the margin that is coming from the legalized states that we might not have been able to access anyway, like 18 to 21-year-olds and that type of customer demographics.

“In terms of the overall plan, we’re actively watching it.

“As we’ve said before, we can’t be out on the lead on this one.

“We’re going to monitor it make sure that we’re not left behind if there’s regulatory clarity, and that we have a good plan in place.

CEO Thomas Reeg followed that with an unequivocal message.

“We will not put any of our licenses at risk,” he said.

“We believe what’s happening in prediction markets is sports gambling.

“If there is a path that develops where we can participate in a way that doesn’t put licenses at risk, you should expect we would be we are preparing and would be prepared to go down that path.”

DraftKings, FanDuel And ESPN Bet

DRAFTKINGS: DraftKings is due to release its Q3 2025 results on November 6. The company has already issued a statement of intent this month by acquiring Railbird, a federally regulated exchange, although at this stage the plan is to offer event contracts across finance, culture and entertainment and avoid sport. It does however put the firm in a solid position to enter the sports market should the opportunity arise in future.

FAN DUEL: Flutter Entertainment, the owner and operator of FanDuel, has scheduled its earnings call for November 12. Like DraftKings, FanDuel has positioned itself within the prediction markets space by teaming up with global derivatives specialist Chicago Mercantile Exchange. Again, the plan is to offer event-based contracts but steer well clear of sport until there is more legal clarity.

ESPN Bet: Penn Entertainment, operator of the ESPN Bet brand, is due to reveal details of its Q3 2023 performance on November 6.