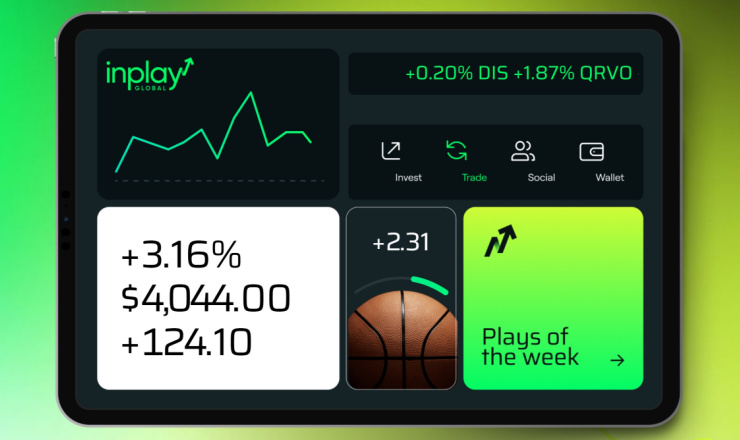

InPlay Global Inc is looking to release a new market platform in the US where people trade performance securities based around real-world teams playing professional and college sports.

It may appear to be another move into the controversial world of sports prediction markets, but InPlay Global says it is about to revolutionise sports performance investing with a platform that would be an industry first.

If it is successful in gaining approval from the Securities and Exchange Commission (SEC) to create its new marketplace, it will do well to avoid not getting caught up in the present row over whether the new phenomenon of sports prediction markets are in fact sports wagering by another name.

It is a high-profile dispute with big bucks at stake, as sports prediction markets exceeded $2 billion in trading volume at operator Kalshi in the first half of this year.

Is Trading Performance Securities Just Sports Gambling?

InPlay states quite clearly that its new regulated trading marketplace for performance securities “is not betting, not gaming and not a prediction market”.

The firm hopes to operate a platform, InPlay Markets, where its users can trade securities tied to a performance fund, in the same way that an index fund operates.

It is aimed at US sports fans and will give them the opportunity to trade those securities with the prices linked to how well or badly a team is doing through a season, in terms of wins and losses.

CEO Edwin Johnson explains: “Financial markets price commodities, equities, and risk, but they have never priced real-world competitive performance.

“InPlay is changing that by introducing a regulated market structure where performance can be evaluated, traded, and risk-managed transparently.

“We are not building a gaming product; we are building a market.”

InPlay Markets To Launch In 2026

Kane said: “Performance Securities apply market discipline to something universal, competition.

“This is not betting, and it isn’t a synthetic stock game.

“It’s a regulated financial marketplace designed around transparent price formation, neutral market operations and unified liquidity.

“I am excited to help bring this new market category to life alongside Edwin and the InPlay team.”

As well as seeking SEC Tier 2 approval that would allow the firm to raise up to $75 million from investors in a 12-month period, InPlay Market will also need approval from the Financial Industry Regulatory Authority (FINRA).

With a green light from the authorities, the plan is to launch in 2026, although InPlay Markets does not yet have any licensing deals in place to offer securities for the likes of the NBA and the NHL.

Sports Betting Versus Prediction Contracts

InPlay is planning its ambitious move into a sports arena that is already rife with conflict.

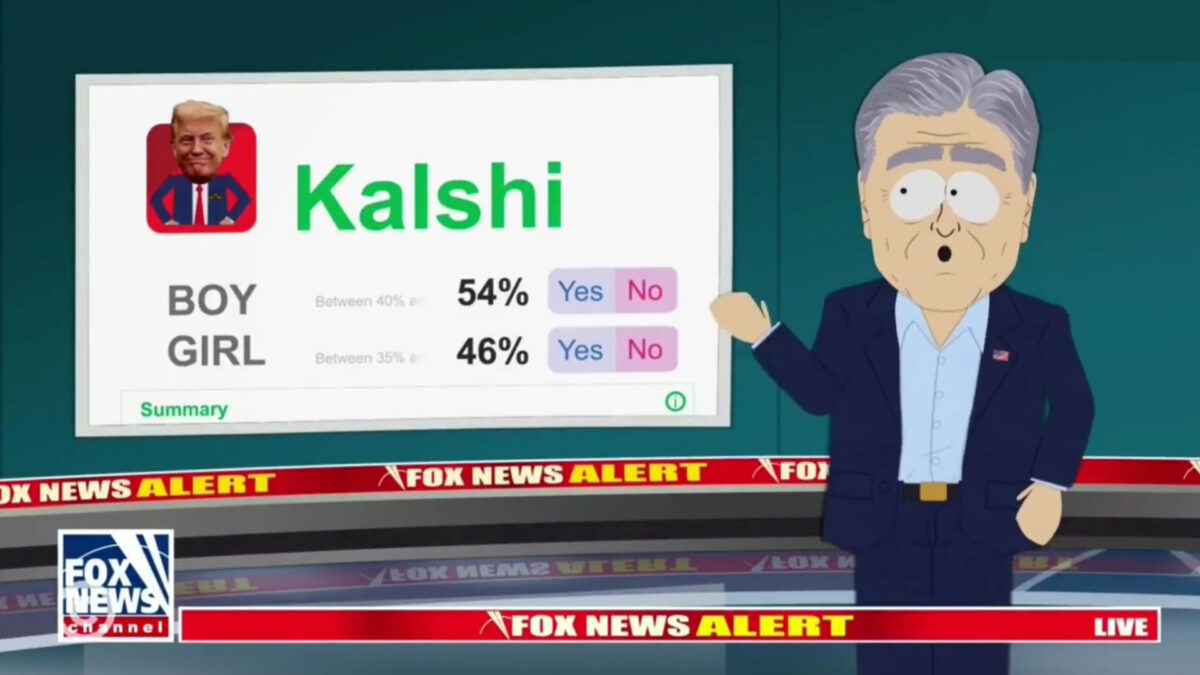

Prediction market specialist Kalshi has been in the firing line of state regulators in the US who claim its sports product is gambling by another name.

Kalshi operates under the jurisdiction of the federal regulator, the Commodity Futures Trading Commission, and is not bound by each individual state’s sports betting legislation.

Kalshi even came to the attention of animated series South Park which based a whole episode around prediction markets.

The big players in the US sports betting industry have been keeping a watchful eye on proceedings, with several backing the opinion of state governors that prediction markets are a form of gambling.

There are still various legal battles being fought through the courts where Kalshi is defending its right to continue trading in sports markets, making predicting what happens next for prediction markets in the US almost impossible.

One thing is for certain, the more progress InPlay makes in creating this new form of sports performance trading, the higher the chance it will face opposition from a betting industry that feels it should be the only body enjoying sport’s financial playground.