Two senior members of the UK’s Betting and Gaming Council (BGC) appeared before a Treasury Committee on Tuesday (October 28) to present a case against a potential hike in gambling tax rates.

CEO Grainne Hurst and Stephen Hodgson, the BGC’s Chair of Tax Committee, took part in a two-hour session in which they spoke against proposals that would see Chancellor Rachel Reeves announce a revised tax system for the betting industry in her Budget on November 26.

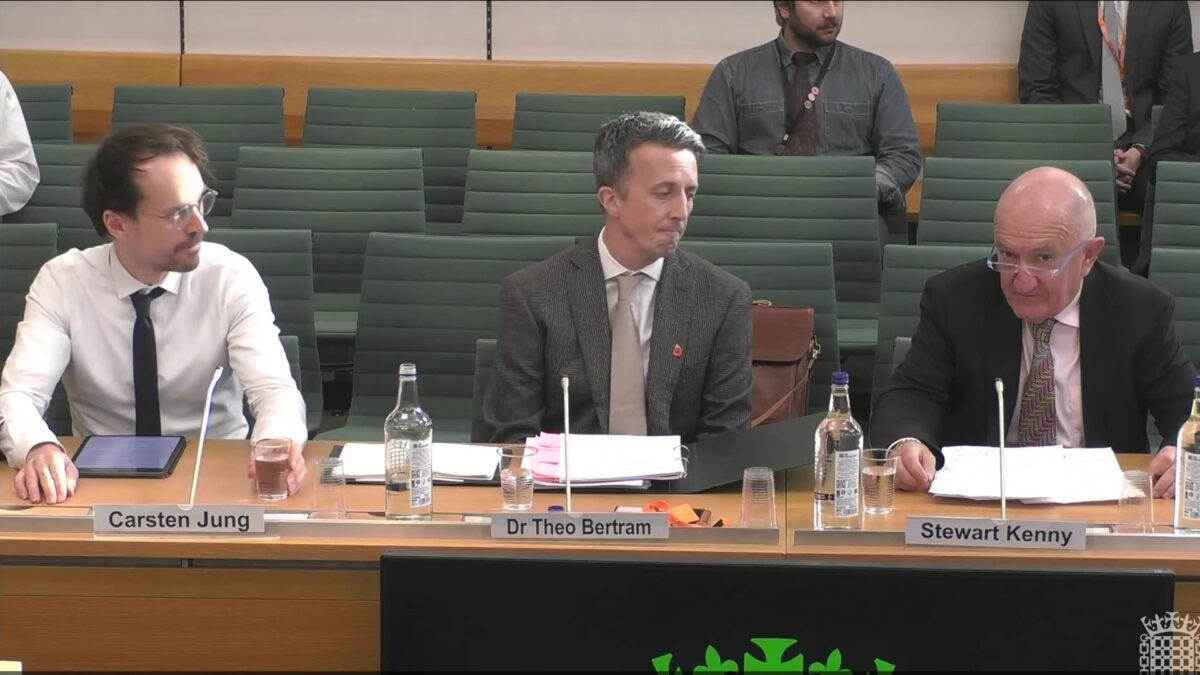

The select committee meeting, which was streamed on ParliamentLive TV, also featured speakers in favour of tax increases.

While the BGC panel attempted to convey that a tax raid on betting threatened 40,000 jobs and would be a £3 billion blow to the sector’s UK economic contribution, Hurst’s refusal to accept that gambling created social problems drew criticism from the Chair of the Treasury Select Committee.

Dame Meg Hillier MP ‘Flabbergasted’

Ahead of asking Hurst and Hodgson to present their evidence, Chair Dame Meg Hillier MP introduced the BGC panel by saying: “You had a bit of a roasting there from the people who feel that gambling should be more taxed.”

During the subsequent debate, Hurst stated that although a minority of people do suffer harm through gambling, the industry is not at fault.

“I think there are people who will have problems with their gambling,” she said, “but that is 0.4% of the population.

“I don’t think it’s right to categorise the gambling industry as creating social harms.”

In a statement released after the meeting, Dame Meg Hillier said she was “flabbergasted” by Hurst’s stance.

“While I accept parts of the gambling industry make an economic and cultural contribution to the UK, I am frankly flabbergasted that representatives from the betting sector could not accept that certain forms of gambling, such as highly addictive online casino games, cause social harm for some people.

“I don’t believe that is a defensible position.”

Paddy Power Co-Founder In Favour Of Tax Rise

One of the key arguments for imposing higher tax rates on the gambling industry is that it should be brought into line with products such as alcohol and tobacco, which are taxed based on their social harms.

Sitting on the panel in favour of new tax measures was Stewart Kenny, a co-founder of Paddy Power in the 1980s.

He was particularly critical of bookmakers who will try to attract users who have placed a sports bet with offers of free spins in their casino products.

“When you open an account to have a bet on the next general election or Manchester United to win the Premiership, within 24 hours they send you free spins in the casino to the online slots,” he said.

“This is taking somebody from the least addictive product to the most addictive product.

“Betting on horse racing or the next general election is less harmful than betting on fixed odds betting terminals or online slots.”

Kenny Dismissive Of Betting Industry Warnings

Kenny resigned from the board at Paddy Power in 2016 after disagreeing with some of the firm’s practices when encouraging users to gamble.

Paddy Power is one of the many betting industry big hitters who have spoken out against potential tax rises.

Fred Done, Chairman and co-founder of Betfred, recently fired a warning that 7,500 jobs would be at risk if tax rates increased, while Flutter-owned Paddy Power said their recent shop closures could be the first of many for the UK betting trade.

Kenny brushed those arguments aside.

“I played that game,” he said, “I was head of the Allied Bookmakers Association in Ireland.

“I played that game every time there was a mention of a tax rise, I was using exactly the same arguments 25 years ago.

“The betting businesses have exploded in profits.

“I do not see any reason why betting shops or people employed in betting shops should go down because of the tax rises.”

He went on to say that shop closures merely reflected the present state of the market.

“Betting shops were closing before these tax rises.

“They’ve announced quite a few were closing in Ireland and the UK recently.

“That’s long before tax rises, so it is just what’s happening.”

Is There Hope For Horseracing?

Earlier this week the British Horseracing Authority sent an open letter asking the Chancellor for a tax rethink, signed by 363 trainers, jockeys and administrators within the industry.

The BHA has rallied against a proposal that would see online betting on horseracing brought up to the same levels as online casinos in a single Remote Betting & Gaming Duty.

Presently there is a 15% duty for online sports betting, including horseracing, while there is a 21% tax on online casino game stakes.

The BHA has argued in its #AxeTheRacingTax campaign that racing provides a community benefit as well as jobs in rural areas and is far removed from the world of online slot machines.

That view received support from within the pro-tax panel yesterday.

Dr Theo Bertram of the Social Market Foundation said: “What we’re really focussed on is this app [gesturing with his hand] and you are just sitting on it in your home, and you are losing huge amounts of money in a very short space of time.

“It’s an adversarial relationship between a bookie and a punter.

“It may be when you’re at football or you’re in an arcade you get something out of that even if you lose.

“When you’re doing that on your app, there is nothing that you gain.

“What we are saying is you’ve got to raise the tax on that and what I’m also saying is that the number of jobs in that area is far fewer.

“In our proposals we are looking to protect racecourses, that’s why we’re actually looking to shift the amount of tax that goes to Treasury towards the horseracing itself, by the switch from gaming duty to the horse racing levy, and we’re also going to exempt small bookies on racecourses altogether.

“We’re looking to protect those kinds of things where even though you may lose money, there’s something you may gain from it because it’s a social activity.

“But don’t let the gambling industry pretend to you that sitting on your phone being addicted to that app and losing thousands of pounds is somehow putting more people into work.

“Having one person more on that app or a thousand people more on that app is negligible cost to them, whereas having a thousand people more betting on horse racing – which would be good to see – is obviously going to bring jobs.”